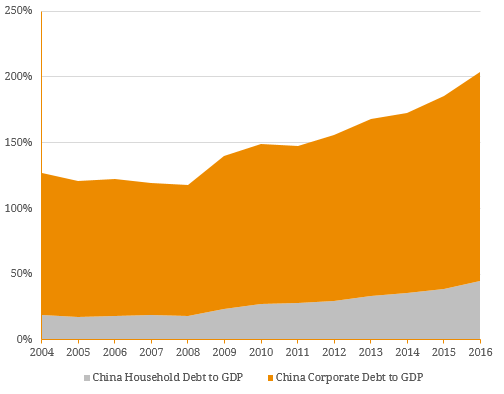

On the 21st of September 2017, S&P downgraded China’s sovereign credit rating (from AA- to A+), following a similar rating cut by Moody’s in May. This was just a few weeks before the 19th national congress in which the top leadership of the nation would be decided. China called the downgrade a “wrong decision” on the back of its perceived strong fundamentals. The main reason for this downgrade was perhaps what the government believed to be its strength – high credit growth in China. In S&P’s eyes, Chinese domestic financial risks arising from excessive systemic debt has risen to such a point where a downgrade would warn investors that the deleveraging process implemented by the Government was working more slowly than expected. Figure 1. China Debt to GDP Ratios  Source: BondAdviser, Bloomberg The higher assessed possibility of default, reflected by such a downgrade, would ordinarily “scare” enough investors to cause the nation’s borrowing costs to rise, if only by a little. However, new Chinese sovereign bonds issued last week tell a different story. On the 26th of October 2017, a month after the downgrade, China offered government bonds in the American market, its first US dollar dominated bonds since 2004. Interestingly, the credibility “deterioration” of the issuer seemed to be less of a concern to investors, who notched $10 billion of demand for the $2 billion unrated offerings. This led to a repricing with the issue margins of the two tranches (each of $1 billion but with different tenors of 5 and 10 years) adjusted to 15 bps and 25 bps over relevant US Treasuries, from initial guidance of 30-40 bps and 40-50 bps respectively. The issuance is expected to trade even tighter in the secondary market. Obviously, investors’ insatiable appetite for new primary offerings continues, even effectively ignoring a significant rating movement so close to the deal. General reasons for investors subscribing to new issues of downgraded entity are varied and would include risk appetites, demand-supply, apathy to formal credit ratings, diversification and broader macroeconomic conditions. The uptake of the Chinese sovereign bonds was specifically attributed to investors’ confidence in Chinese economy and improving USA investing environments etc. In our view, more importantly perhaps was that many investors would have been attracted by the scarcity of US$ dominated Chinese sovereign bonds given the country has actively promoted Chinese Yuan issues for the past few years. Although the deal ($2 billion) was not of considerably large size, this certainly revealed China’s increasing tendency to access foreign capital markets. Additionally, given the ease of this deal, this could potentially encourage more Chinese credits to tap US$ markets. If that happens, China may be able to create a full yield curve of US$ dominated securities and domestic issuers intending to tap foreign capital markets will be able to also proxy their securities from this new offshore sovereign benchmark. This of course will only further encourage such issuance and will facilitate more economical and rational trading opportunities. The Chinese sovereign bond issuance did not only underpin the US market’s ready accessibility for foreign names, but again demonstrated the investment penetration from one economy to another. In such a globally unified financial world, investors are increasingly provided with more diversified investment avenues and an individual entity’s financial stability should be enhanced with access to more capital markets. Nevertheless, it is also worth noting that systematic risks (contagion) are simultaneously increased to some degree with interactions and reactions between capital markets being positively reinforced.

Source: BondAdviser, Bloomberg The higher assessed possibility of default, reflected by such a downgrade, would ordinarily “scare” enough investors to cause the nation’s borrowing costs to rise, if only by a little. However, new Chinese sovereign bonds issued last week tell a different story. On the 26th of October 2017, a month after the downgrade, China offered government bonds in the American market, its first US dollar dominated bonds since 2004. Interestingly, the credibility “deterioration” of the issuer seemed to be less of a concern to investors, who notched $10 billion of demand for the $2 billion unrated offerings. This led to a repricing with the issue margins of the two tranches (each of $1 billion but with different tenors of 5 and 10 years) adjusted to 15 bps and 25 bps over relevant US Treasuries, from initial guidance of 30-40 bps and 40-50 bps respectively. The issuance is expected to trade even tighter in the secondary market. Obviously, investors’ insatiable appetite for new primary offerings continues, even effectively ignoring a significant rating movement so close to the deal. General reasons for investors subscribing to new issues of downgraded entity are varied and would include risk appetites, demand-supply, apathy to formal credit ratings, diversification and broader macroeconomic conditions. The uptake of the Chinese sovereign bonds was specifically attributed to investors’ confidence in Chinese economy and improving USA investing environments etc. In our view, more importantly perhaps was that many investors would have been attracted by the scarcity of US$ dominated Chinese sovereign bonds given the country has actively promoted Chinese Yuan issues for the past few years. Although the deal ($2 billion) was not of considerably large size, this certainly revealed China’s increasing tendency to access foreign capital markets. Additionally, given the ease of this deal, this could potentially encourage more Chinese credits to tap US$ markets. If that happens, China may be able to create a full yield curve of US$ dominated securities and domestic issuers intending to tap foreign capital markets will be able to also proxy their securities from this new offshore sovereign benchmark. This of course will only further encourage such issuance and will facilitate more economical and rational trading opportunities. The Chinese sovereign bond issuance did not only underpin the US market’s ready accessibility for foreign names, but again demonstrated the investment penetration from one economy to another. In such a globally unified financial world, investors are increasingly provided with more diversified investment avenues and an individual entity’s financial stability should be enhanced with access to more capital markets. Nevertheless, it is also worth noting that systematic risks (contagion) are simultaneously increased to some degree with interactions and reactions between capital markets being positively reinforced.