In Australia the fixed income asset class receives comparatively less media attention than equities. For this reason, many investors find fixed income jargon, research and its related concepts confusing and hard to understand. However, in periods of extreme volatility relatively safe income securities can be the backstop to portfolio losses by offsetting the underperformance of other asset classes. While equities are viewed as a growth asset, fixed income is classified as a defensive asset. As a result, capital protection, income generation and diversification are first priority when investing in fixed income securities to minimise volatility and reduce the probability of capital loss. This will ensure that a steady income will be paid over the life time of the security and more importantly, the principal will be paid back at maturity. Although this seems simple enough, misunderstanding of these key principles is one of the major downfalls of Australian investors. While a truly balanced portfolio would include both equity and fixed income, selection criteria is quite different. As fixed income is primarily a defensive asset class, the primary objective of analysis is to avoid bad issuers rather than seeking growth prospects (as priortised in equity analysis). The real driver of fixed income value is the probability of the underlying issuer deteriorating over the life of the security. While you may be successful with a 60%-win rate in equities, this success would be a failure in the world of fixed income. It is therefore imperative that investors understand this concept before they venture into the Australian fixed income market. Structural Differences:

- Term: Fixed Income securities have a fixed term while equities are viewed as a perpetual investment.

- Income: Fixed Income securities offer agreed periodic interest payment schedule over the term of the investment. On the other hand, there is no promise of dividends for equity holders.

- Return: Specified rate of return depending on the capital price of the fixed income securities and value of scheduled interest payments. There is no specified return for equity holders and future value is much more uncertain and subject to greater volatility.

- Capital: Fixed Income investors received full capital repayment at the end of their investment in the absence of the issuer defaulting. Equity investors receive the end market value of their shares.

- Ranking: In the event of default, claims made by debt investors rank ahead of equities.

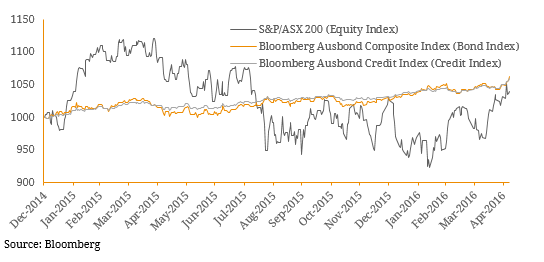

Figure 1. Fixed Income Performance Vs Equity Performance