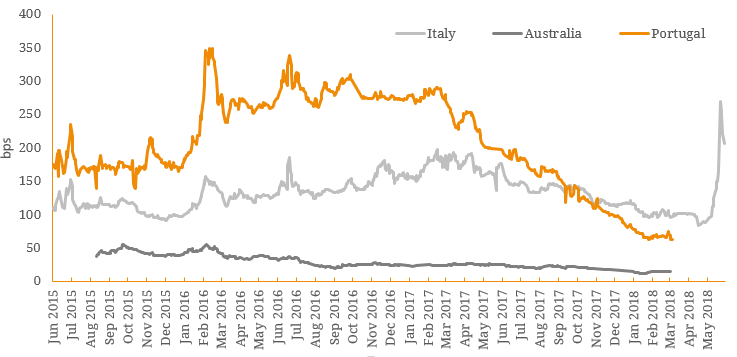

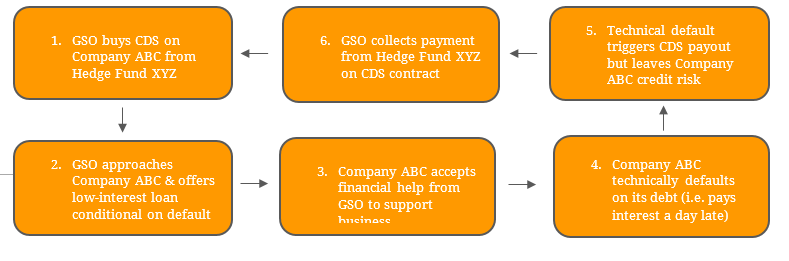

The mere mention of credit-default swaps (CDS) would cause many investors to cast their minds back to 2008, when these credit derivatives were at the heart of the global financial crisis (GFC). In case you missed Margot Robbie’s explanation in the 2015 film, The Big Short, a CDS is a form of contract in which the purchaser gets paid out if the counterparty fails to pay its debt obligations. In the case of the GFC, several Wall Street investors purchased billions of dollars of exposure through CDS, which were then paid out when millions of homeowners defaulted on their mortgages, causing the sub-prime mortgage housing collapse and triggering the GFC. In credit terms, CDS spreads are used as an indicator of financial distress, and therefore a measure of an entity’s credit risk. When a debt issuer starts to exhibit financial distress, investors buy a CDS contract to effectively provide an insurance policy against an event of default. The spread represents the premium a buyer pays to the seller of the CDS and provides an indicator of the perceived risk involved in the underlying debt obligation (i.e. mortgage, bond etc). Figure 1 below shows the different prices or spreads paid on CDS contracts for Australia, Portugal and Italy over recent years. The low spreads on Australian CDS reflect the lower perceived credit risk compared to the two European economies, with a clear spike in the Italian spread reflective of the recent political and fiscal policy uncertainty surrounding the nation’s finances. Figure 1. 5-Year CDS spreads for Australia, Portugal and Italy.  Source: BondAdviser, Bloomberg This week, CDS contracts have been back in the spotlight due to the activities of Blackstone-operated hedge fund, GSO Capital Partners (GSO). GSO was particularly active in the CDS market in 2015-2016, and, as a hedge fund, this would ordinarily be business-as-usual, except that GSO’s were not using CDS in a standard way. Effectively, GSO would purchase one side of a CDS contract on a company in financial distress from a rival fund, then approach the referenced company and offer them a low-interest loan to help them get out of financial trouble. The catch? The company had to go into technical default on their debt obligations, which in turn would trigger the CDS payout from the rival fund, reaping GSO a tidy profit whilst the company’s credit profile and fundamentals remained largely unchanged (Figure 2). Figure 2. GSO leveraged its deep pockets to outsmart rival hedge funds

Source: BondAdviser, Bloomberg This week, CDS contracts have been back in the spotlight due to the activities of Blackstone-operated hedge fund, GSO Capital Partners (GSO). GSO was particularly active in the CDS market in 2015-2016, and, as a hedge fund, this would ordinarily be business-as-usual, except that GSO’s were not using CDS in a standard way. Effectively, GSO would purchase one side of a CDS contract on a company in financial distress from a rival fund, then approach the referenced company and offer them a low-interest loan to help them get out of financial trouble. The catch? The company had to go into technical default on their debt obligations, which in turn would trigger the CDS payout from the rival fund, reaping GSO a tidy profit whilst the company’s credit profile and fundamentals remained largely unchanged (Figure 2). Figure 2. GSO leveraged its deep pockets to outsmart rival hedge funds  Source: BondAdviser, Bloomberg This use of CDS contracts to trigger “manufactured defaults”, whilst not illegal, has been considered bending the rules in the $10 trillion derivatives market by many of the biggest names in trading including investment banking giant, Goldman Sachs. Whilst GSO has largely exited this trading strategy following the departures of key executives, the decision has left several outstanding lawsuits and large settlements in its wake and left many calling for structural change to the CDS market to prevent this kind of behaviour in the future. Whilst the use of CDS contracts as both a hedging and speculative tool remains prominent, these derivatives remain complex financial instruments best utilised by sophisticated investors (i.e. hedge funds and financial institutions). Issues including a lack of liquidity are prevalent in the domestic CDS market, with significant short-term price volatility compared to major banks and A-rated corporate bonds – reflecting perhaps the increased risk in CDS contract trading.

Source: BondAdviser, Bloomberg This use of CDS contracts to trigger “manufactured defaults”, whilst not illegal, has been considered bending the rules in the $10 trillion derivatives market by many of the biggest names in trading including investment banking giant, Goldman Sachs. Whilst GSO has largely exited this trading strategy following the departures of key executives, the decision has left several outstanding lawsuits and large settlements in its wake and left many calling for structural change to the CDS market to prevent this kind of behaviour in the future. Whilst the use of CDS contracts as both a hedging and speculative tool remains prominent, these derivatives remain complex financial instruments best utilised by sophisticated investors (i.e. hedge funds and financial institutions). Issues including a lack of liquidity are prevalent in the domestic CDS market, with significant short-term price volatility compared to major banks and A-rated corporate bonds – reflecting perhaps the increased risk in CDS contract trading.